November 2, 2015

If you have an existing network of territories currently in operation, you have a range of data and information available to be analysed. The types of analysis that can be carried out depend on what data is available, whether it’s a geographical analysis from customer postcodes, sales data or we look at carrying out a socio-economic profile, a wealth of tools exist to give you the best understanding of how your business performs today. This can then be used to re-map your current network or create territories moving forward, ensuring that franchisees are awarded a fair territory and your businesses achieves the best growth across the network.

An example analysis

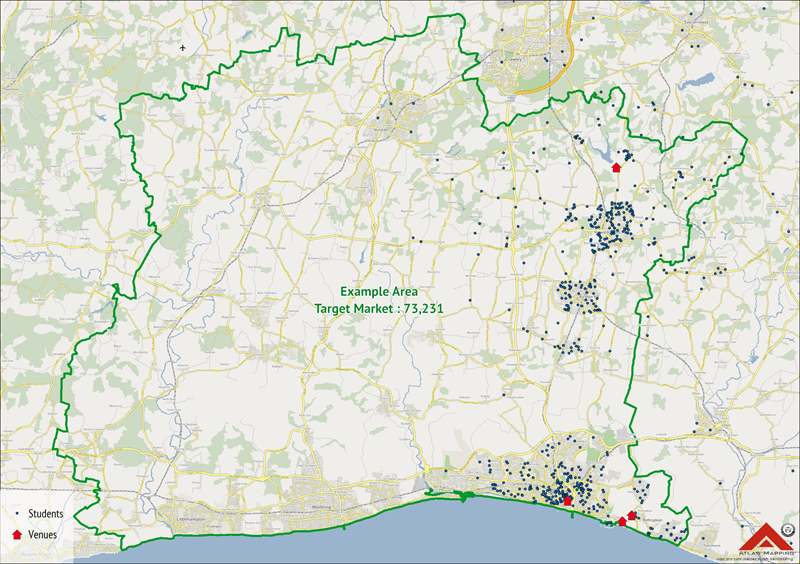

The most common form of analysis that we carry out is a geographic analysis. This just requires a list of customer Postcodes and the territory or site that they belong to. In this example the client has a network of around 90 territories averaging around 70,000 target market, we carried out the analysis in the following steps.

Step 1

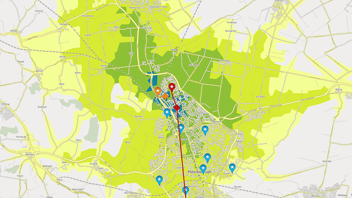

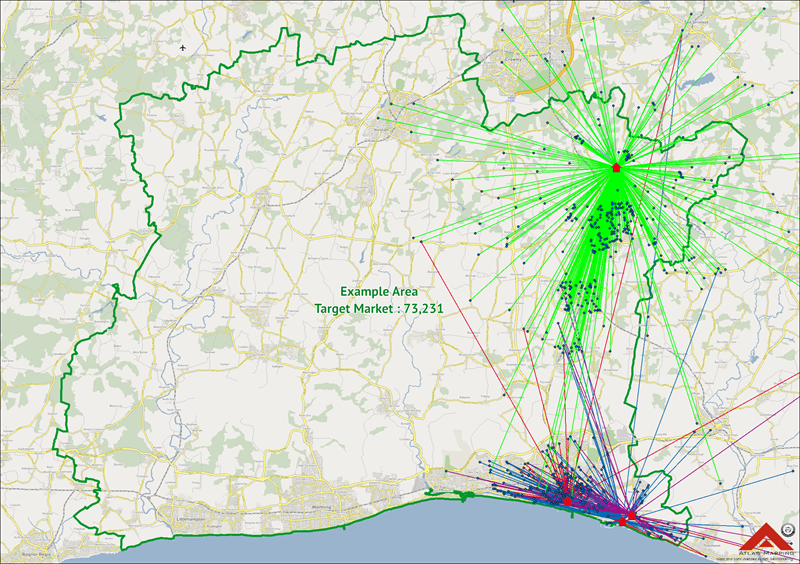

We imported the data into our mapping software to create a visualisation of the existing network. As you can see in the example below the territory boundary has been drawn, and the sites and customers have been plotted for this particular area.

In the second image, we’ve applied star diagrams to highlight the customers that attend each site and any crossover between catchment areas.

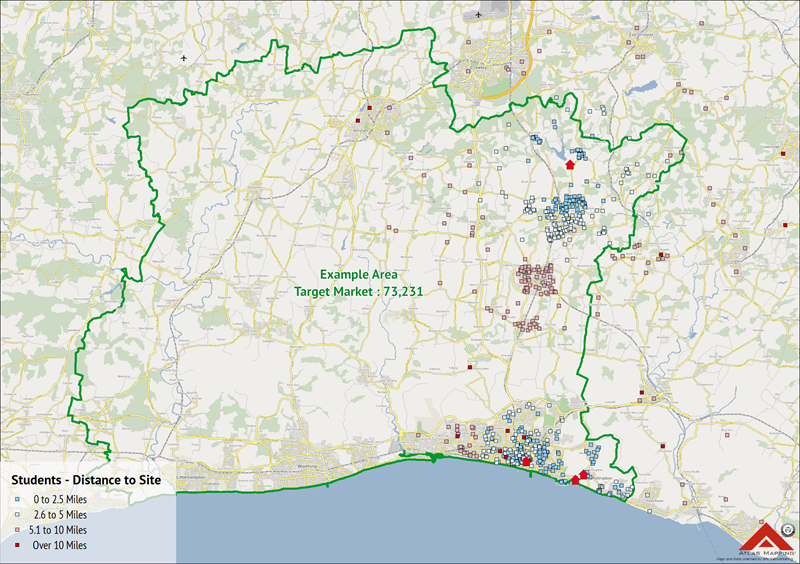

In the third image, we’ve calculated drive times and distances from customers to the site they attend. From this analysis, we can tell that on average customers travel 5 miles to a site which works out between a 10 and 15-minute drive time. This valuable insight can then, of course, be taken into account when creating territories moving forward and evaluating the size of those that have already been awarded.

Step 2

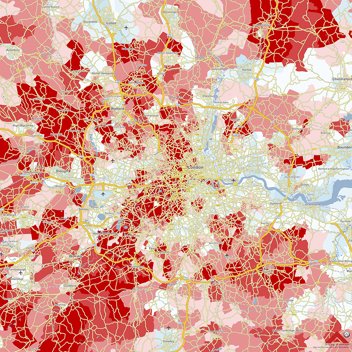

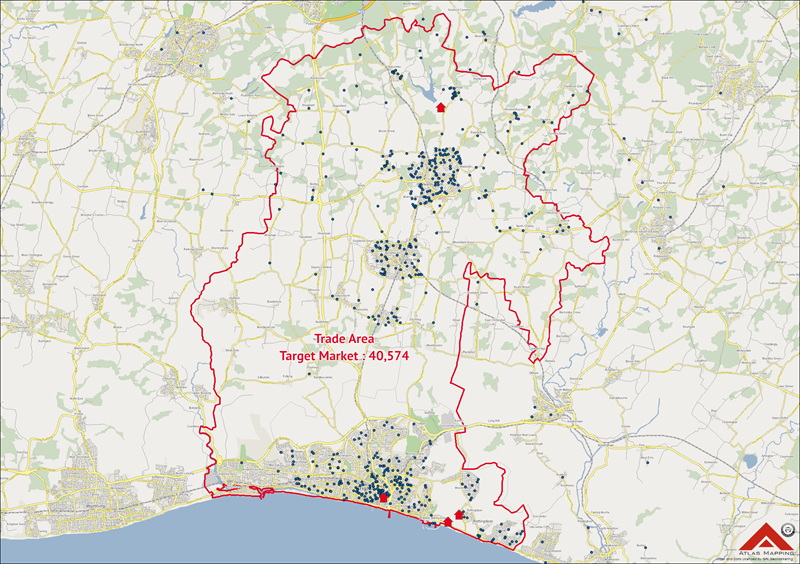

As the first image highlights, almost half of the territory isn’t being serviced, so our next step is to create a territory that better represents the actual trade area of the franchisee.

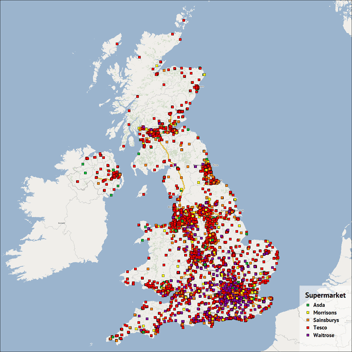

We can now take a look at the level of market penetration being achieved and put this into our territory calculation worksheet. With some client input to let us know how many customers are required for a franchisee to operate comfortably, we are now able to make an informed decision on the number of target market a territory needs for a franchisee to be able to achieve this based upon the existing market penetration figure.

In this example it has indicated that territories moving forward should look to contain 20,000 target market, this allows the example client to achieve around 325 territories across the UK, over three times the size of the existing network of territories based on the original figure of 70,000.

Step 3

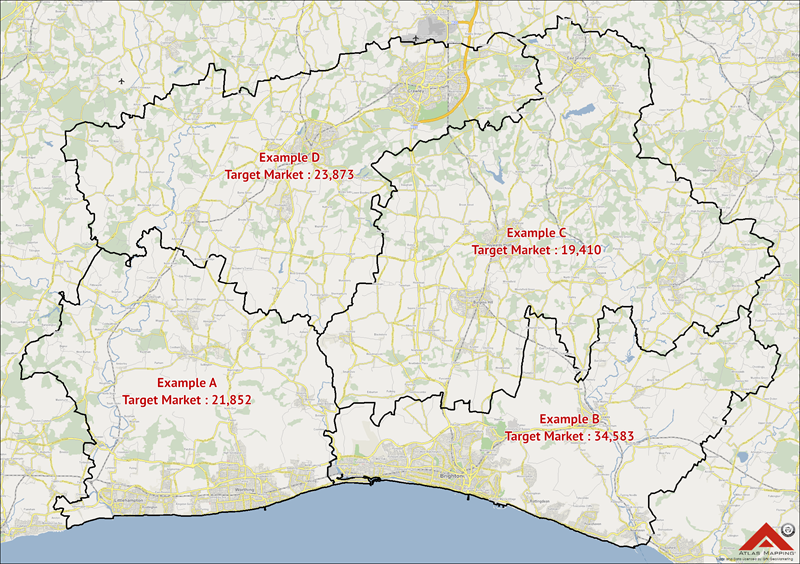

We’ve now created some new example territories showing how the existing area will look once it has been re-mapped. As you can see the original area has now been split into four new and more manageable territories. This provides much more flexibility to the client when negotiating with a prospective franchisee, and is much easier to add-in performance based clauses on extra territories taken on by a new franchisee.

Just to recap, we’ve seen in this example that the original territory contained over 70,000 target market, and yet the franchisee was only servicing half of the territory. We’ve used the geographical analysis to show that territories could actually contain a number closer to 20,000 that suits the business as it stands to date.

Furthermore, just because the territories are smaller, it doesn’t mean that they can’t be bolted on together to make larger territories, you can award a geographic area that matches the franchisees ambition, but it gives you the control to manage their performance targets. We’ve found, as have our clients that it gives them the best platform to manage the growth of their network, based on an up-to-date picture of what’s happening across their territories.